An Open Letter to Congressman Dwight Evans - Keeping the Lights on for Small Business

March 24, 2020

The Honorable Dwight Evans

United States House of Representatives

1105 Longworth

Washington, DC 20515

Dear Congressman Evans:

As the owners of The Constitutional Walking Tour of Philadelphia (“The Constitutional”), Leslie and I are writing to respectfully request meaningful and immediate government assistance in response to the Coronavirus pandemic in terms of:

- providing grants to small businesses; and

- providing gap coverage to small businesses for their business interruption/lost business income insurance policies that exempt losses from the Coronavirus as a covered loss.

Overview

The Constitutional Walking Tour provides guided tours of America’s Birthplace at Independence National Historical Park in your District. We are one of the leading providers of school field trips to Historic Philadelphia, and school field trips (which primarily take place in the Spring) are our bread and butter. With the prospect of our entire Spring season, including school field trips being cancelled, we (as small business owners) are forecasting devastating financial losses, and worried about the continuity of our business to fully recover from this unprecedented shutdown and shock to our economy.

The Constitutional is a family owned and operated small business that employs about 30 people annually, primarily as tour guides and hospitality managers. For the last few weeks, we have seen all new business bookings disappear, and moreover many of our current reservations through at least June 30, 2020 cancel. Since we founded our business in 2003, we have never experienced anything quite like this before, and we are very concerned.

On March 20, 2020, the U.S. Travel Association, on behalf of more than 6,000 travel industry organizations including The Constitutional Walking Tour, sent a joint letter to Congressional leadership requesting aggressive and immediate financial relief in light of the Coronavirus pandemic. According to the U.S. Travel Association, America’s travel industry comprises "an economic sector that directly employs 9 million American workers and supports a total of 15.8 million jobs. The travel and tourism industryincluding but not limited to transportation, lodging, recreation and entertainment, food and beverage, meetings, conferences and business events, travel advisors, destination marketersis comprised of businesses of all sizes, but the vast majority, 83%, are small businesses" (such as The Constitutional).

Establishing Workforce Stabilization Fund and Providing Grants to Employers and Employees

As detailed in the March 20, 2020 letter from the U.S. Travel Association to Congressional leadership, we are requesting aggressive and immediate financial relief in light of the coronavirus pandemic. Specifically, we are in support of establishing a $250 Billon Travel Workforce Stabilization Fund at the U.S. Department of the Treasury to keep workers in their jobs and provide compensation to employers and employees for economic losses incurred in the interest of public health.

Converting Small Business Administration Loans to Grants

While we appreciate that you introduced a Bill that would generate $7.0 Billion more in financing for Economic Injury Disaster Loans through the Small Business Administration and speed up the program, we are writing to respectfully request that a larger portion of SBA loans be converted to grants for small businesses such as The Constitutional to keep operations, including employment, at pre-Coronavirus levels.

The idea of taking on debt at this time (even if providing a personal guarantee from business owners is waived) is just not viable to us. The reasons why we do not believe that these SBA loans are viable at this juncture are based on our losses sustained and forecasted, the uncertainty of if and when our business may resume normal operations, and even if we do return to business as pre-Coronavirus levels, our margins are low which will make it more difficult to service principal and interest repayments.

Including Partner Distributions in Paycheck Protection Program

The Constitutional is incorporated as a Limited Liability Company (LLC), and the compensation that business owners receive in the form of draws (or distributions) should be included in the calculation of "Average Monthly Payroll" which is the underlying and determining variable with how much a business can receive as part of Paycheck Protection Program (PPP) of the CARES Act.

However, in the absence of specific government guidance on LLC owners' compensation being included in the calculation of "Average Monthly Payroll", everything that I have seen floating out there indicates that draws (or distributions) to LLC owners are NOT part of the Salaries, Wages, and Tips from line 2 on tax form 941, or commissions, etc. from the tax form 1099. Therefore the "paychecks" that LLC owners receive as their compensation are excluded from the Average Monthly Payroll calculation. My hope that this is just an oversight that will be corrected to include LLC owners' compensation in the calculation of Average Monthly Payroll for PPP.

Compensation for Partner/Members of a Limited Liability Company should be included in measures to protect small business owners since our distribution/partner income are our "paychecks". It just does not seem equitable that owners of an S Corp., for example, can be compensated on payroll and therefore included in PPP, but owners of an LLC cannot receive ordinary payroll compensation and therefore excluded from PPP.

Providing Gap Coverage for Business Interruption Insurance Policies that Exempt Coronavirus Claims as a Covered Loss

We are requesting that the Federal government provide gap coverage for any small business with business interruption insurance that will exclude claims based on Coronavirus losses.

This is necessary since we (which concurs from similar reports from other small businesses) have been verbally informed that our commercial liability insurance policy excludes business interruption and extra expense coverage pertaining to the losses directly and indirectly associated with the Coronavirus pandemic.

As a consequence of the recent governmental travel advisories/restrictions and increasing public fear over contraction of coronavirus, businesses such as ours which are located in areas where human contraction of coronavirus has been concentrated are experiencing significant disruptions. We had hoped that our business interruption insurance would respond with coverage for these income losses. However, the initial response seems to indicate that our policy will not cover our business interruption since we have not had a physical loss to property (i.e., fire, storm damage).

Typically purchased as part of a company’s commercial property insurance policy, business interruption insurance is intended to protect businesses against income losses sustained as a result of disruptions to their operations. Contingent business interruption coverage similarly provides insurance for financial losses resulting from disruptions to a business’s customers or suppliers, usually requiring that the underlying cause of damage to the customer or supplier be of a type covered with respect to the business’s own property.

As we are unfortunately learning, business interruption extensions like contingent business income, ingress/egress, loss of attraction and even civil authority claims all require physical loss or damage by a covered peril. Further property policies may address denial of access, yet are subject to policy exclusions for pathogenic organisms, viruses, and disease- or illness-causing agents. Most traditional property insurance policies will not respond to claims resulting from slowdowns or shutdowns due to the spread of a pandemic.

In many commercial property insurance policies, business interruption coverage is triggered when the policyholder sustains “direct physical loss of or damage to” insured property by a covered cause of loss. In the event of a claim for Coronavirus-related business interruption, certain insurance carriers such as ours may dispute whether this “physical loss” requirement has been met. That said, even without a physical loss of property, we are experiencing business interruption.

According to the law firm Jones Day,

“Policyholders should keep in mind, however, that courts across the country have not settled upon a uniform rule for when insured property has suffered a ‘physical loss.’ Courts in a number of jurisdictions have determined that contamination and other incidents that render property uninhabitable or otherwise unfit for its intended use constitutes a ‘physical loss’ sufficient to trigger business interruption coverage. The determination of whether ‘physical loss’ has occurred will therefore continue to require a close examination of the particular facts of each case.

In addition, many commercial property insurance policies provide coverage for business income losses sustained when a “civil authority” prohibits or impairs access to the policyholder’s premises. Depending upon its specific wording, a policy’s “civil authority” coverage may or may not require that the access restriction result from 'physical loss' by a covered cause of loss and, if so, often does not require that “physical loss” occur to the policyholder’s own property. Accordingly, in the event that a federal, state, or local governmental authority limits access to or from areas where active transmission of an infectious disease has been identified, 'civil authority' coverage may respond with insurance for the attendant income losses of affected businesses.”

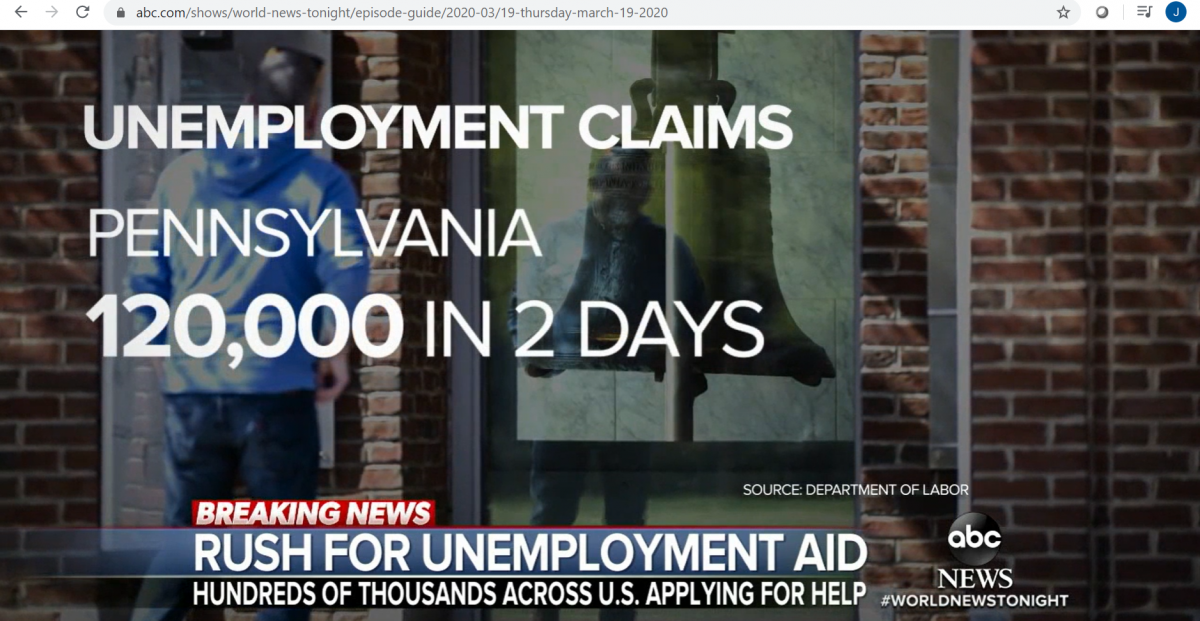

ABC News Featured Unemployment in Pennsylvania with the Liberty Bell as a Backdrop

On March 19, 2020, ABC News World News Tonight broadcast a story about the Coronavirus crisis causing a large spike in national unemployment claims. The story showed the Liberty Bell at Independence National Historical Park in Philadelphia, and discussed 120,000 claims for unemployment in Pennsylvania in just the past couple of days from March 17-19, 2020. While the story did not discuss unemployment directly or indirectly involving the national parks, the image is compelling with a national park visitor looking into a shuttered Liberty Bell Center at America’s Birthplace.

Unemployment Surges Nationally, Including in Pennsylvania

On March 26, 2020, The Washington Post reported that "A record 3.3 million Americans filed for unemployment benefits as the coronavirus slams economy - The U.S. unemployment rate has likely risen to 5.5 percent already -- a level not seen since 2015."

On March 26, 2020, The Philadelphia Inquirer reported that "About 645,000 Pennsylvanians have filed for unemployment compensation in the 10 days since Gov. Tom Wolf first ordered a statewide shutdown to slow the coronavirus, according to new numbers released Thursday, the clearest picture to-date of the damage to the economy."

The Bottom Line

The bottom line is that our losses continue to mount every day, and our insurance is up for renewal in April 2020. In addition, our fixed costs continue to accrue every day. Our marketing, operations, hiring and training costs to prepare for the Spring season are sunk costs. We have employees who have left Philadelphia since their schools closed their on/off-campus housing. Our staff is highly trained, so losing any member of our staff has a significant cost and moreover may impact whether we are able to successfully restart and recover. Further, we have mounting costs with customers demanding refunds (please see our Statement on Coronavirus).

We are respectfully urging you to help us prepare for the broad economic effects from actions taken to contain the spread of COVID-19, and to evaluate all possible means to assist small businesses during this unprecedented period. Governments must implement the measures they consider necessary to contain the spread of COVID-19, and must be prepared for the wide scale economic implications that will result from those measures.

Tourism is an important economic engine for Philadelphia, and we are committed to ensuring the health and resiliency of our industry. However, we need meaningful and sustained assistance to get through these unprecedented times. Thank you for your consideration and efforts.

Sincerely,

Jon and Leslie Bari